BuT bUt BuT tHiNk AbOuT tHe MaSsIvE dIvIdEnD pOtEnTiAl WhEn ItS tEcH fUlLy MaTuReS! iT mAkEs Me FeEl LiKe I gEt To OwN sUm SpAcEx ToO!!!

Choose again.

BuT bUt BuT tHiNk AbOuT tHe MaSsIvE dIvIdEnD pOtEnTiAl WhEn ItS tEcH fUlLy MaTuReS! iT mAkEs Me FeEl LiKe I gEt To OwN sUm SpAcEx ToO!!!

The price the market is willing to pay for one share of stock vs the amount of profit the company is making per share.

A P/E of 90 means someone is willing to pay $90 for a share of a company that is netting $1 of profit for each outstanding share it has.

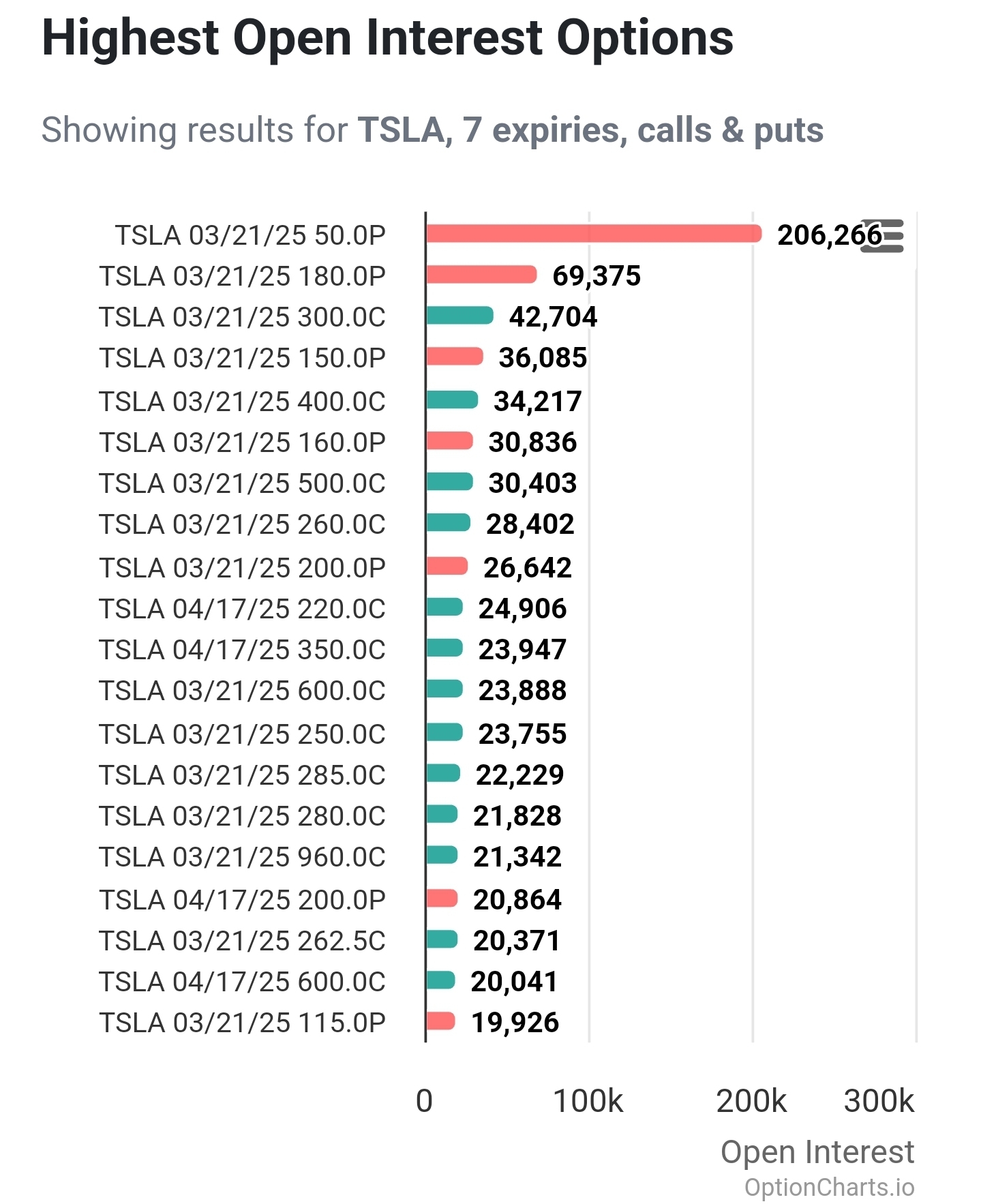

I wanted to join the selloff party so badly, I traded all my Total Market ETF holdings for (Tesla-free) Large Cap Value ETFs, and with the change left over I bought the cheapest Tesla Puts I could find.

I just love that open pessimism for Friday’s Put contracts!

“They should all be destroyed”

I wouldn’t try that.

Recycling this quote and article again:

Be judicious about the degree of productive capacity you can exhibit…

Being genuinely nice equates to being weak in their perspective. Being nice is only relevant when it’s a tool for getting something in return.

Obviously the leftist cult trans wokists infiltrated HAARP to activate the negatively-polarized nanobearings suspended in chemtrails, which generated the storms and lubricated the tornadoes for maximum destruction. Only God could have seen this coming, but He was distracted praising Dear Leader for giving the world’s most perfect speech to the Department of Justice.

It’s so weird to realize some people saw the scene where Neo woke up and thought “Heeeeeeyyyy, now that’s a pretty nice way to do things. Someone (preferably me) should do that!” instead of a natural sense of revulsion.

Ehhhhhhhhh, I think I’d prefer gentle asphyxiation by nitrogen or a lethal dose of morphine or sudden teleportation to the center of a star.

Geez you communicated that perfectly.

Bingo. Disarm, detain, distrain.

I’ve been having a recent craving to rewatch Conspiracy (2001) in light of the past year.

Be judicious about the degree of productive capacity you can exhibit…

Number of registered firearms purchased. Family members’ names and locations.

I feel very small…

It’s one of the reasons it’s in my top 2 places to live within the next couple years.

Do you think they’ve accessed records for the past election to build a database holding every voter and their respective vote(s)?

Performative in MN, but in locations more sympathetic to the GOP agenda is it a beacon of inspiration and blueprint for legalized oppression?

Can that even happen in a capitalist society? I thought the pursuit of profit was supposed to fix everything. It almost feels like thefacebook doesn’t have its users’, or even society’s, best interests at heart. If only someone could have made a full length feature film warning everyone about this 15 years ago!

Wonder how the dust will affect crop yields…

I am mostly a disciple of Boglehead investing philosophy.

A seminal resource early in my adult life was The Wealthy Barber, which I think still stands up well as a sensible guide to low-stress, long-term investing.

An ETF is basically a thing you buy, like shares of stock, but each share of an ETF is made of a blend of a bunch of stocks. VTI is an ETF run by the brokerage Vanguard that tries to track the entire US stock market, weighted against how large a company is. You should try to find ETFs with a low “expense ratio”, which is basically the management fee for a blended fund. VTI is really low, something like 0.03%. So you pay vanguard $3 for every $10,000 gained (I think it works like that, anyway. All I know is it’s low and that’s good).

I don’t endorse playing with Options Contracts unless you have an iron stomach and incredible self discipline. It’s legalized gambling in my view (although it has other valid uses, like hedging against losses…but it’s an advanced tool and can wreak havoc on savings when used poorly).